No products in the cart.

And Just Like That / Sex and the City party

From NYC style food, the decor and of course costumes, sharing my Sex and the City – And Just Like That… party! My friends showed up in character and we celebrated the new series on HBO Max!

Everyone dressed up SATC inspired, or their favorite character – the actual costume remake. Look how much fun we had making this reel!

View this post on Instagram

For some reason this scene stands out to me from the movie and I just had to do this! Thanks to my friend Jennifer for letting me use her kitchen and kids, and dog! No real icing on the booty – just a iron on transfer so I can actually sit on my furniture without worrying! Now let’s go into the party decor and what to wear ideas!

Here are some highlights from my Instagram Stories – check out our reel here which was SO fun to see everyone in character.

Party decorations

Excuse the not professional pics, but I was really enjoying my party and hosting and forgot to take photos!

Use these props to decorate or place the food on for display. Click on image to be taken to link to purchase on Amazon. Click here to see all these items in an Amazon list and you can easily add the items you wish to cart!

^^ I stuck them in the pretzels and on cupcakes for fun

^^ City building. Place cups filled with soft pretzels and cheese on here. With the picks.

^^ Put soft pretzels in these cups. Or small food cups!

^^Or black cups, which I think I like too!

^^ These paper taxis were used as food boxes. I put in pretzels and pretzel bites! I cut off the tops with a box cutter!

No one really drinks a lot in my group who came so I poured pink Shirley temple drinks in the glasses for fun!

^^ Martini glasses – if you don’t drink just fill it with a colorful sparkling pink lemonade! It’s just for photos anyway right?

I had cake pops made and the white ones said “I (heart) NY” on them. They were delicious and I like the lemon flavor! Link to who made them – Julie also made my birthday cake and rose cupcakes!

The backdrop fun

You always need some kind of fun activity, how about a NYC backdrop? This one is 7 feet tall and 5 feet wide.

This looked great with the girls walking down – it was one that was tall enough because the others were only 5 feet tall. You may not get a group but you’ll get one person and you can have the next person walk. Might make a fun reel!

The food

Maybe no naked sushi, but I doubt anyone is really coming for the food. So, let’s make it easy, NY street food!

- NY style pizza (Streets of New York, Sbarro, NYPD Pizza) delivery!

- Soft pretzel bites – don’t forget the cheese! You can order Annie Anne’s delivery or frozen.

- Hot dogs

- Manhattans and/or Martinis (make them mocktails if you’d like!)

- Apples for props

- Pink cupcakes (a nod to Charlotte).

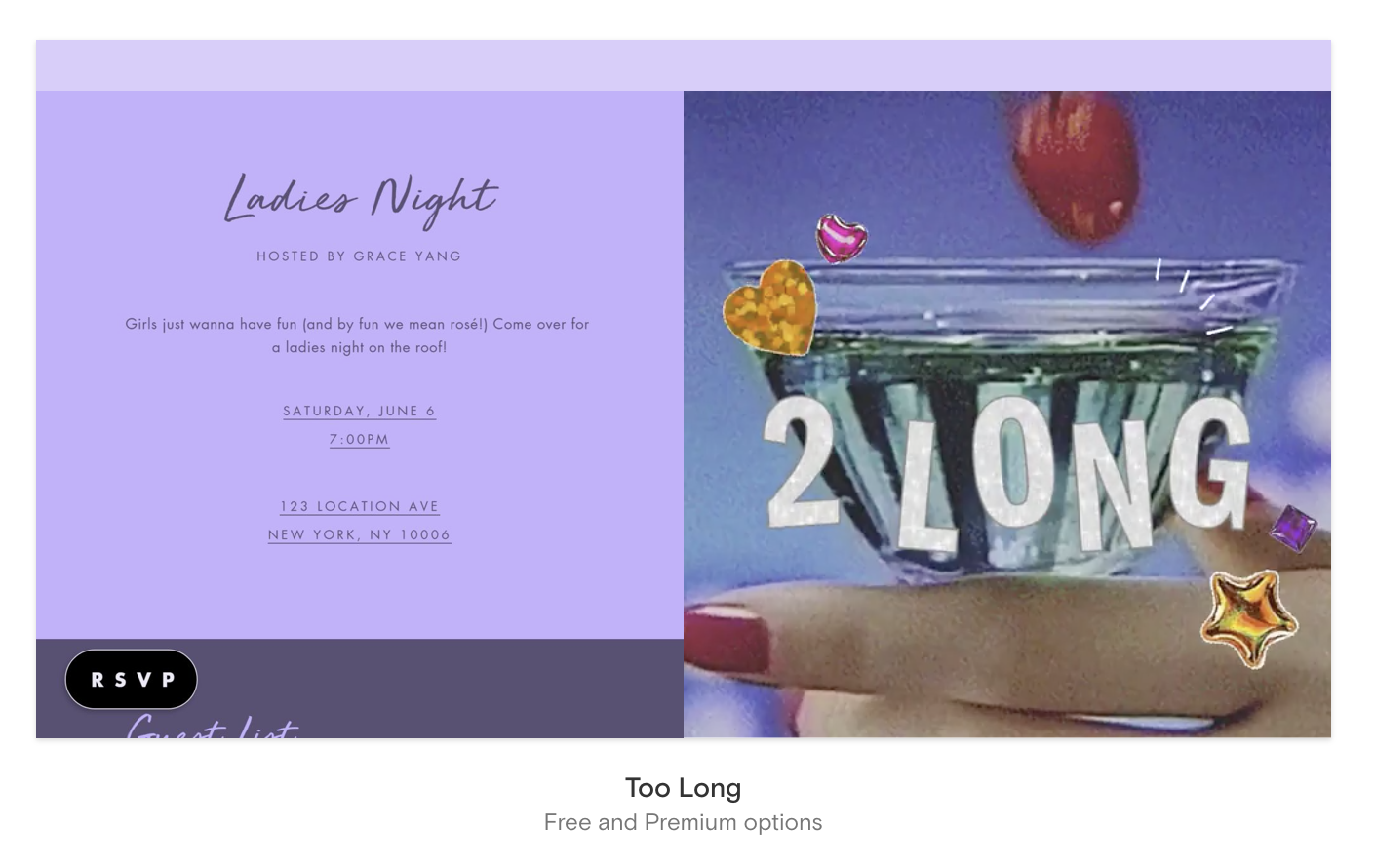

The invitation

I like this Been 2 Long by Paperless Post (send it via text or email for free). You can personalize the stickers and the words.

Browse the other options for cocktail parties here.

What to wear

I say dress up like your favorite character, or an iconic outfit from a scene. Here are some ideas on what to wear to a Sex and the City, or And Just Like That… party! Which character are you? Take the Which Sex and the City character are you quiz on Buzfeed.

Like Charlotte’s cupcake look! I bought this apron on Poshmark for $10 and I was so excited! Bonus if you can get a kid’s red hand print on the vintage Valentino.

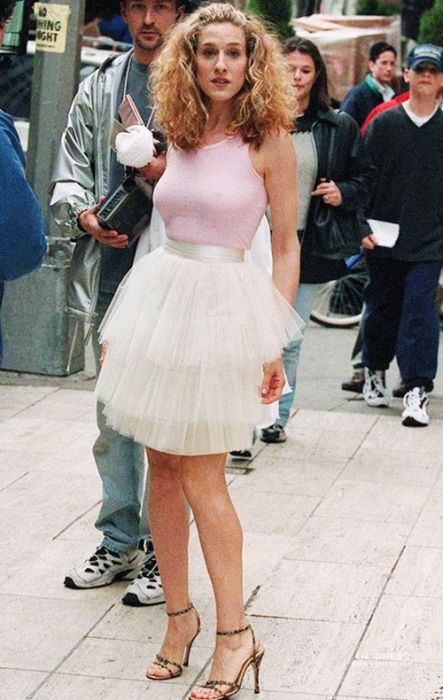

Or – Carrie’s opening tutu look. Or her Paris look. Sigh.

Don’t forget your name plate necklace, order it now. I ordered mine :) If you have a guest list that you know won’t flake, and you can make the investment, it’d be so fun to order as party favors!

Or wear your vintage Chanel and power suit and be Samantha! I know, we’re all sad Kim isn’t returning so maybe it would just be sad to dress up as her so let’s just admire her outfits.

I can just hear her voice now.

Or if you want to be smart and comfy, wear one of Miranda’s Harvard oversized hoodies. I promise everyone will be jealous of your comfy and clever outfit!

Or dress fashionable as the ladies of SATC will be. Ah! I cannot wait for the fashion!!! One thing I am looking forward to is seeing older women embracing fashion, their lifestyle and as a woman who is just a decade behind, I want to look up to older women who show that life isn’t over past 40 (which I obviously know).

- See Amazon item list to add the items to cart

- See the Pinterest board for more And Just Like That party ideas

- Take the Which Sex and the City Character Are You – quiz

Diana Elizabeth is onto the next party of course!

POST COMMENT